Offer payment by cheque on a website

In the age of the Web, the Internet, digital technology and contactless payments, some people are still looking for cheque payment solutions on the Internet.

In France, some consumers are still relatively attached to this type of payment.

Discover why offer payment by check on the Internet and how to protect yourself.

Why offer payment by cheque on a website?

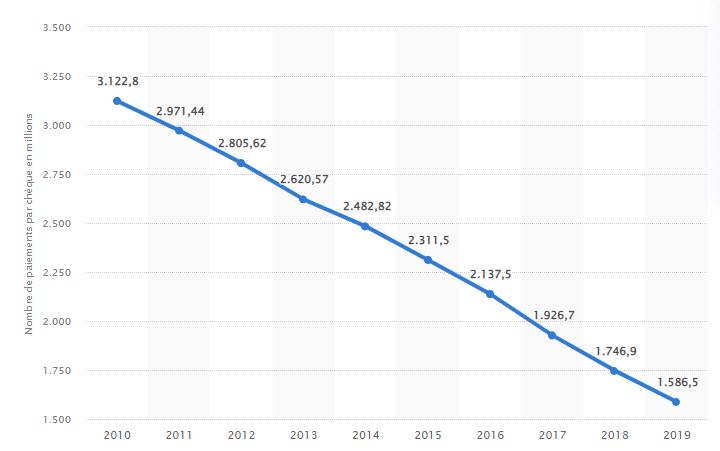

In 2019, a Statistica study still showed nearly 1.5 billion payments by check in France, down since 2010, but still present.

In 2017, cheques still accounted for 3 billion euros in transactions, or 15% of total transactions.

Graph: Number of cheque payments in France from 2010 to 2019 (in millions)

Today, the customer is looking for a deferred payment, in several instalments and for large amounts.

C’est exactement ce type de besoin que le chèque peut remplir pour une partie de la population.

Le chèque est souvent apprécié par des consommateurs pour effectuer des paiements conséquents.

La limite du montant d’un chèque est souvent plus élevée que le plafond d’une carte bleue.

C’est également un moyen de paiement différé.

Le client sera débité une fois que le chèque sera encaissé par le vendeur, ce qui lui laisse le temps de s’organiser.

Le montant de l’achat peut être échelonné, ainsi le consommateur réalise plusieurs chèques pour répartir la somme dans le temps.

How can you offer payment by cheque on your site?

Offering payment by cheque on your site is an interesting opportunity, but it means trusting your customer.

The increasing number of fraudulent or unpaid cheques is taking its toll on retailers.

In order to succeed, we therefore strongly recommend that you plan for every eventuality by setting up an upstream partnership with an external collection service.

To set up this type of service on your website, payment services offer turnkey solutions for easy installation of the payment module.

You need to tell your customer how to send and fill in the cheque.

The more precise you are, the more likely you are to receive payment quickly.

You then take charge of managing the check: cashing, cash flow monitoring, order release.

In the case of a simple one-off payment, you shouldn’t detect any losses, as you only release the order once the cheque has been cashed.

If, however, you decide to accept payment by cheque in instalments, you run the risk of unpaid or bounced cheques.

This is where a collection company can help.

As an alternative to CB payments or tools such as digital wallets, online payment by cheque still has its fair share of supporters.

Many people in France are still attached to this classic method of payment.

A site with payment by cheque offers potential customers new consumer opportunities.

To find out more about our payment protection solution, contact us!