International collection issues

International trade is a boon for many companies, who now have the opportunity to sell goods and services across borders.

But it can happen, as in the case of a local commercial transaction, that a customer fails to pay an invoice.

In such cases, the merchant needs to carry out an international collection procedure.

SSPCollect reports on international collection international debt collection and how to protect yourself against non-payment abroad.

CONTENTS :

- Taking into account the particularities of each country

- Out-of-court collection difficulties in certain countries

- International legal recovery: costs and delays lengthen

- Call on an international collections expert

Taking into account the particularities of each country

International trade forces companies to take an interest in the countries of their potential customers.

Des différences de cultures, de langues, de coutumes peuvent exister et elles devront être prises en compte par le commerçant.

Legislation, commercial rules and payment deadlines will also be different. from one country to another.

It is therefore important to take into account the particularities of each countryIt’s also important to surround yourself with professionals who have a good knowledge of the industry, to avoid disputes and misunderstandings.

This lack of knowledge can be an obstacle to obtaining payment of your debt through amicable collection.

Out-of-court collection difficulties in certain countries

When you initiate amicable collection procedures abroad, you apply the rules in force in the country in question.

The effectiveness of amicable collection procedures varies widely from country to country.

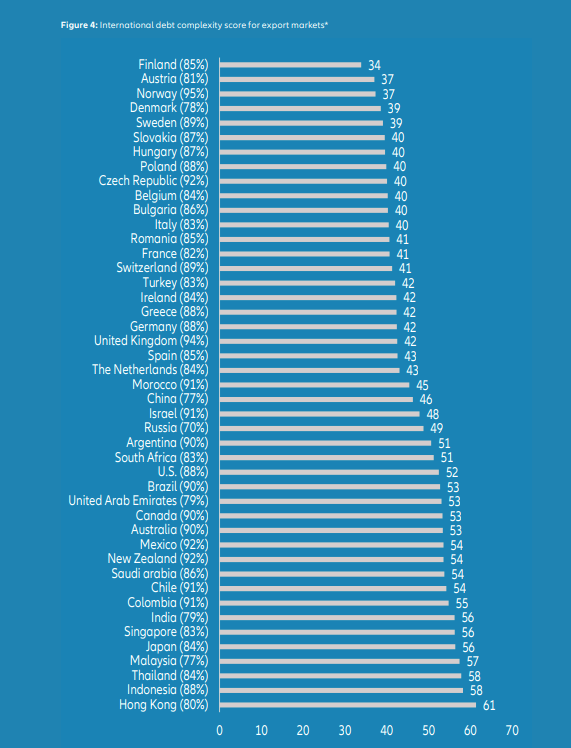

While debt collection in Western countries is relatively efficient, it is far more complex in regions such as Asia, Africa and Latin America. The Allianz study ” Commercial debt collection “This study looks at collection complexity scores by country.

This study imputes a score for each country that depends on :

- Local payment practices (17%)

- Local legal proceedings (31%)

- Local insolvency proceedings (51%)

Chart: International debt complexity score for export markets

International legal recovery: costs and delays lengthen

If amicable collection fails, it will be possible to initiate legal collection proceedings. internationally.

Depending on the country of the claim, these procedures will take varying lengths of time.

Debt collection in Europe: simplified procedures

European debt collection procedures have been designed to simplify legal collection between European Union countries.

Simplified procedures have thus been created, such as :

- The European Enforcement Order

- European payment order

- Settlement procedure (disputes under €2,000)

These procedures, which are specific to European trade, do not necessarily guarantee debt recovery.

Portugal and Italy, for example, have long collection times.

Debt collection outside Europe

Procedures outside Europe can be long and costly, especially in countries like Australia and the USA, but if you’re well accompanied, you’ll have a good chance of getting your money back.

In Asia, as the Allianz study shows, legal proceedings are long and complex, all the more so if you’re not very familiar with the procedures.

In all cases, an international receivables professional can advise you on your claim and the most effective procedures for recovering what you owe.

Call on an international collections expert

Commercial practices and legislation differ from country to country, SSPCollect can help you deal with international collection issues thanks to the SEKUNDI networknetwork, present in over 60 countries.

For greater efficiency, your file is transmitted directly in the country concerned to our trusted partner.

You have just one point of entry into the business relationship, whatever the country.

The advantages of SSPCOLLECT’s international solution with the SEKUNDI network:

- 1 single SSPCOLLECT contact in all countries.

- Knowledge and mastery of in-country collection methods.

- Respect for habits and customs for optimum efficiency.

- NO CURE / NO PAY” pricing: 15% of the amount collected on success.